The RBI maintained its benchmark repo rate at 6.5 per cent for the ninth consecutive policy meeting, citing persistent high food inflation as a key concern. The RBI’s focus remains on controlling inflation while supporting economic growth, and it continues with a policy stance of ‘withdrawal of accommodation.”

Mumbai: The Reserve Bank of India expectedly kept the benchmark interest rate and stance unchanged for the ninth straight policy meeting, saying it cannot afford to look through persisting high food inflation and has to remain vigilant to prevent spillover.

Retaining its unambiguous focus on inflation, the Monetary Policy Committee (MPC), which consists of three RBI and three external members, kept the benchmark repurchase or repo rate unchanged at 6.50 per cent.

Four out of the six members of MPC voted in favour of the rate decision. The panel, whose four-year term ends in October, also decided to retain a policy stance at “withdrawal of accommodation” to aid MPC’s focus on bringing inflation towards its 4 per cent target.

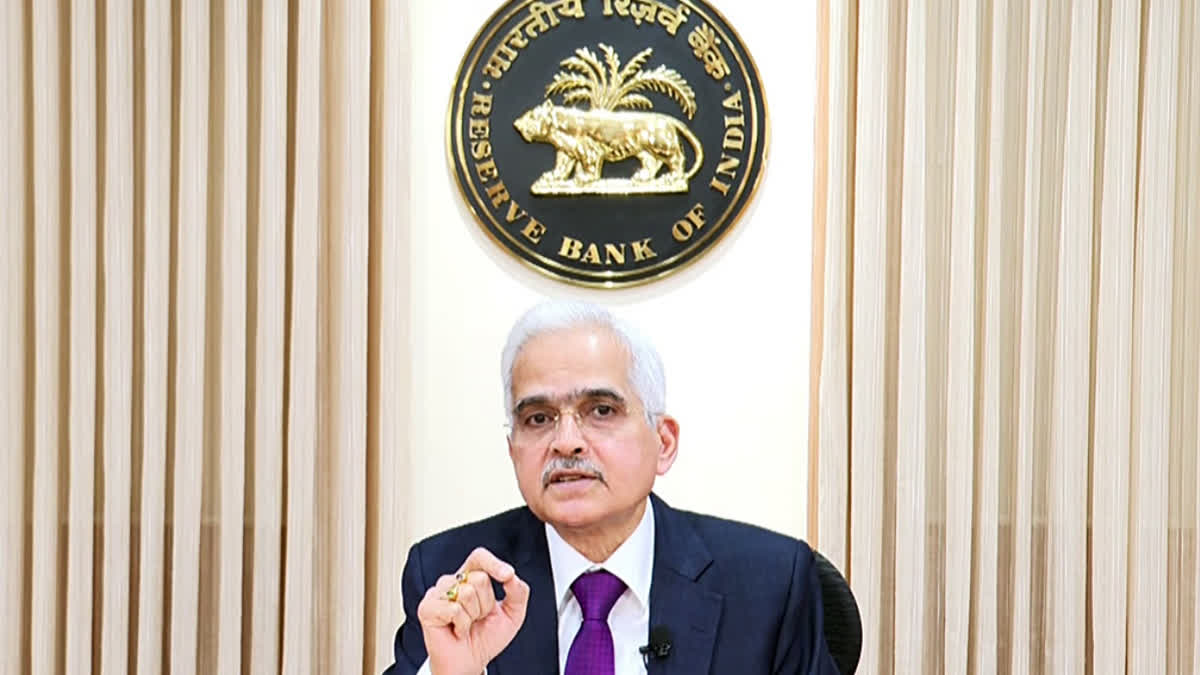

Inflation climbed to 5.08 per cent in June, primarily driven by the food component. RBI Governor Shaktikanta Das said food inflation remains “stubbornly” high. “Without price stability, high growth cannot be sustained,” he said, adding that “monetary policy must continue to be disinflationary”.

He said the MPC could have looked through high food inflation if it was transitory. “But in an environment of persisting high food inflation, as we are experiencing now, the MPC cannot afford to do so. It has to remain vigilant to prevent spillovers or second-round effects from persistent food inflation and preserve the gains made so far in monetary policy credibility.”

The MPC last revised interest rate in February 2023, when it was hiked to 6.5 per cent. The status quo by RBI comes amid varied central bank action in advanced economies. While the Bank of England reduced interest rates last week, the Bank of Japan hiked rates to their highest levels since 2008. Also, fears of a US recession have risen on the back of weak employment numbers, piling up pressure on the Federal Reserve to start cutting rates to support the economy.

RBI retained India’s GDP growth forecast at 7.2 per cent and headline CPI inflation at 4.5 per cent for the current fiscal 2024-25. Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank said, that with growth remaining robust, the MPC still has room to hold on to policy stance to get confirmation on the disinflationary trend.

“We continue to expect scope for change in stance in the October policy with rate cuts beginning from December. The prospects of simultaneous change in stance and rate cuts could increase depending on how domestic inflation and global environment transitions,” she said.

Radhika Rao, Executive Director and Senior Economist, DBS Bank said, policy guidance reinforced that domestic considerations will be prioritised, despite a sharp buildup in rate cut pricing for the US Fed.

“The RBI MPC retained its cautious tone on inflation, in the face of an anticipated passthrough from perishables price pressures and tariff adjustments. With domestic demand conditions calling for a focus on inflation, we expect the policy rate to stay on hold for the rest of the year,” Rao added.

The Governor flagged alternative investment avenues becoming more attractive to retail customers leading to bank deposits trailing loan growth. Though he did not specify the alternate avenues, he may have been referring to investors flocking the stock markets.

“As a result, banks are taking greater recourse to short-term non-retail deposits and other instruments of liability to meet the incremental credit demand. This, as I emphasised elsewhere, may potentially expose the banking system to structural liquidity issues,” he said urging banks to focus more on mobilisation of household financial savings through innovative products and services.

Das also warned of excess leverage through retail loans as well as growing top-up housing loans. While growth in retail loans calls for careful assessment and calibration of underwriting standards and post-sanction monitoring, top-up housing loans may get deployed in unproductive segments or for speculative purposes in absence of no strict monitoring of end use of funds.

Among the measures announced on Thursday included raising of limit for tax payments through UPI from Rs 1 lakh to Rs 5 lakh per transaction, clearing of cheques within a few hours, and introduction of a facility of delegated payments in UPI.

“Under the current monetary policy setting, inflation and growth are evolving in a balanced manner and overall macroeconomic conditions are stable. Growth remains resilient, inflation has been trending downward and we have made progress in achieving price stability, but we have more distance to cover,” Das said.

“The progress towards our goal of price stability has been uneven due to large and persistent supply side shocks, especially in food items. We, therefore, need to remain vigilant to ensure that inflation moves sustainably towards the target while supporting growth. This approach would be net positive for sustained high growth.”